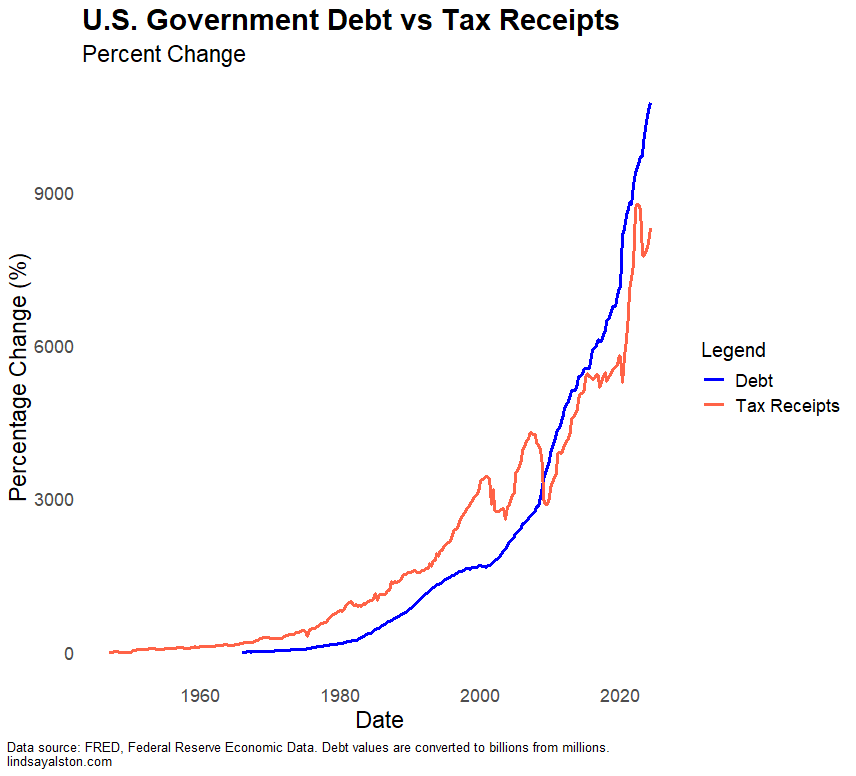

The chart paints a stark picture of the U.S. government’s growing debt under a fiat currency system, where money is created by government decree rather than being backed by tangible assets like gold. The rapid expansion of debt, outpacing tax receipts, illustrates a key feature of a fiat currency: the government can continuously borrow and create money to meet its spending needs, without the need for physical backing such as gold or other commodities.

This ability to create money allows for significant government spending, but it also leads to inflation and a gradual devaluation of the currency. The sharp rise in debt, especially post-2000s, shows how the government has increasingly relied on borrowing rather than generating revenue through taxes or wealth creation. However, while a fiat currency system provides short-term flexibility, the long-term implications are troubling, as debt grows exponentially without sufficient tax revenue to cover it.

Furthermore, this power to create money and debt has significant implications. A notable example is the $2 trillion that was reported as “missing” by the Pentagon the day before the September 11, 2001 attacks. This raises questions about the potential for misuse or lack of transparency within a system where the government can effectively create money at will. The chart suggests that this system encourages both government overreach and fiscal irresponsibility, as debt continues to climb with little accountability.

Other instances of misuse or missing funds further illustrate the risks associated with the fiat currency system. During the 2008 financial crisis, the Troubled Asset Relief Program (TARP) allocated $700 billion to stabilize the banking system. However, audits later revealed that billions were mismanaged, with funds allocated to banks and companies without clear oversight. Similarly, the Department of Housing and Urban Development (HUD) has faced scrutiny for mismanaging billions of dollars in housing funds, with a 2018 audit revealing improper spending on housing programs.

Additionally, reconstruction funds for Afghanistan, totaling over $145 billion, were largely wasted due to corruption, inefficiency, and poor oversight. Fraudulent contractors and local officials siphoned off much of the money, leaving behind incomplete projects and unmet goals.

In essence, while a fiat currency system offers flexibility and immediate solutions to economic challenges, it can also lead to long-term instability. The accelerating debt, especially in times of crisis, can create a vicious cycle of borrowing, inflation, and eventual devaluation. Moreover, the system is prone to mismanagement, as evidenced by historical instances of missing or misused funds. This underlines a core issue with fiat currency: it is susceptible to both economic mismanagement and corruption, which can undermine the sustainability of the economy.