Andrew Jackson and William McKinley serve as two pivotal figures in the history of the United States whose approaches to managing national debt and economic policy offer valuable lessons for contemporary fiscal challenges. Despite the absence of the Federal Reserve during their presidencies, both leaders leveraged unique strategies to manage public debt and sustain economic growth.

Andrew Jackson’s Strategy: Fiscal Prudence and Debt Elimination

Andrew Jackson remains the only U.S. president to successfully eliminate the national debt. His approach was grounded in aggressive fiscal discipline and a staunch opposition to central banking institutions. Jackson viewed debt as a source of dependency and moral corruption, prioritizing its elimination to safeguard economic independence.

To achieve this, Jackson implemented several measures:

- Sale of Public Lands: The federal government relied heavily on revenue from the sale of western lands. These funds, combined with tariffs, formed the backbone of federal income in the absence of income taxes or a Federal Reserve.

- Limited Federal Spending: Jackson curtailed federal expenditures, ensuring the government operated within its means. His administration emphasized paying down existing debt rather than incurring new obligations.

- Dismantling the Second Bank of the United States: Jackson vehemently opposed centralized banking, which he viewed as a vehicle for elite control over the economy. By vetoing the renewal of the Second Bank’s charter, he decentralized financial power, although this led to economic volatility.

The result of Jackson’s policies was a brief period in 1835 when the U.S. operated without national debt. However, the lack of a robust financial system contributed to subsequent economic instability, including the Panic of 1837.

William McKinley: Economic Growth and the Gold Standard

William McKinley’s presidency, though centered on economic expansion, offers complementary strategies for managing debt and inflation. Unlike Jackson, McKinley presided over an era of industrial growth and globalization, emphasizing a stable monetary policy and fostering business confidence.

Key elements of McKinley’s strategy included:

- The Gold Standard Act: By firmly tying U.S. currency to gold, McKinley stabilized the dollar, which was critical in maintaining international trust and controlling inflation. This move ensured predictability in trade and investment, fostering economic growth.

- Tariffs as Revenue: Like Jackson, McKinley relied on tariffs to fund the government. His administration passed the Dingley Tariff, which imposed high duties on imports to protect domestic industries and generate federal income.

- Economic Expansion: McKinley encouraged industrial and technological advancements, which increased productivity and expanded the tax base, indirectly reducing the debt-to-GDP ratio.

Integrating Jacksonian and McKinley Strategies Today

Modern policymakers could combine Jackson’s fiscal prudence with McKinley’s emphasis on economic growth to address the dual challenges of debt and inflation:

- Revenue Diversification: Emulating Jackson’s reliance on land sales and McKinley’s tariff policies, the government could explore non-debt-based revenue sources, such as leasing public assets or imposing targeted tariffs.

- Debt Reduction Mandates: Following Jackson’s model, stricter budgetary controls and prioritizing debt repayment could reduce reliance on deficit financing.

- Economic Growth through Innovation: Like McKinley, fostering innovation and expanding the industrial base could increase revenues without raising taxes, making debt more manageable in the long term.

- Monetary Stability: While returning to a gold standard is unlikely, ensuring monetary policy aims at long-term price stability could control inflation, akin to McKinley’s approach.

Lessons on Funding Without a Federal Reserve

Both presidents governed before the establishment of the Federal Reserve in 1913, relying on tariffs, excise taxes, and land sales for federal revenue. This decentralized model minimized reliance on borrowing but required careful fiscal management and a focus on economic growth to offset revenue volatility.

By combining Jackson’s emphasis on fiscal restraint with McKinley’s growth-oriented policies, the U.S. could chart a path toward sustainable debt reduction and inflation control while fostering a resilient economy.

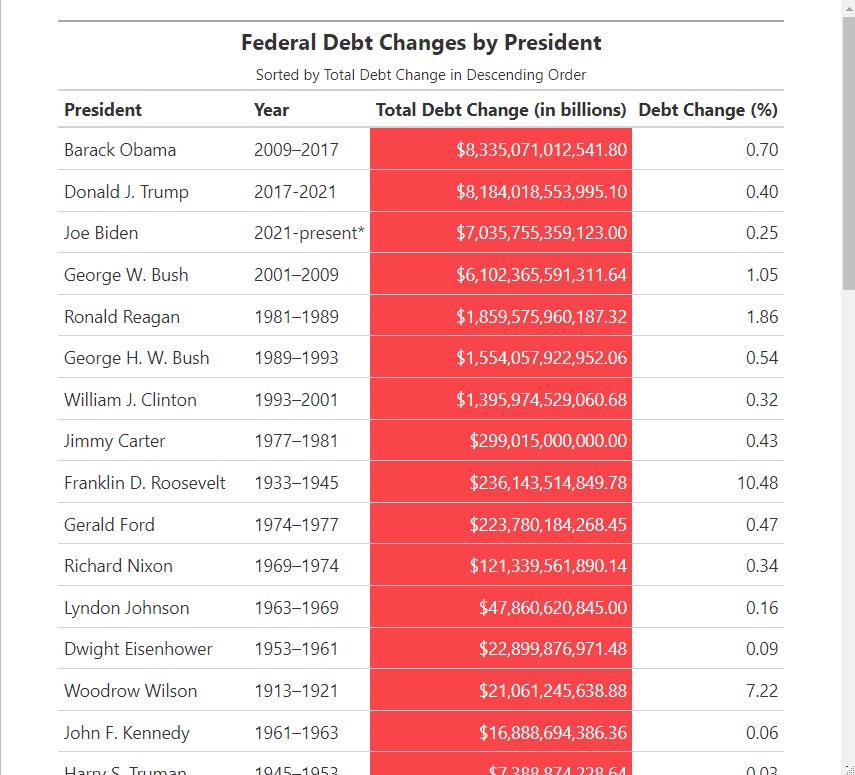

| Federal Debt Changes by President | |||

| Sorted by Total Debt Change in Descending Order | |||

| President | Year | Total Debt Change (in billions) | Debt Change (%) |

|---|---|---|---|

| Barack Obama | 2009–2017 | $8,335,071,012,541.80 | 0.70 |

| Donald J. Trump | 2017-2021 | $8,184,018,553,995.10 | 0.40 |

| Joe Biden | 2021-present* | $7,035,755,359,123.00 | 0.25 |

| George W. Bush | 2001–2009 | $6,102,365,591,311.64 | 1.05 |

| Ronald Reagan | 1981–1989 | $1,859,575,960,187.32 | 1.86 |

| George H. W. Bush | 1989–1993 | $1,554,057,922,952.06 | 0.54 |

| William J. Clinton | 1993–2001 | $1,395,974,529,060.68 | 0.32 |

| Jimmy Carter | 1977–1981 | $299,015,000,000.00 | 0.43 |

| Franklin D. Roosevelt | 1933–1945 | $236,143,514,849.78 | 10.48 |

| Gerald Ford | 1974–1977 | $223,780,184,268.45 | 0.47 |

| Richard Nixon | 1969–1974 | $121,339,561,890.14 | 0.34 |

| Lyndon Johnson | 1963–1969 | $47,860,620,845.00 | 0.16 |

| Dwight Eisenhower | 1953–1961 | $22,899,876,971.48 | 0.09 |

| Woodrow Wilson | 1913–1921 | $21,061,245,638.88 | 7.22 |

| John F. Kennedy | 1961–1963 | $16,888,694,386.36 | 0.06 |

| Harry S. Truman | 1945–1953 | $7,388,874,228.64 | 0.03 |

| Herbert Hoover | 1929–1933 | $5,607,584,076.05 | 0.33 |

| Abraham Lincoln | 1861–1865 | $2,590,066,996.02 | 28.59 |

| Theodore Roosevelt | 1901–1909 | $496,219,307.15 | 0.23 |

| William McKinley | 1897–1901 | $325,654,267.99 | 0.18 |

| William H. Taft | 1909–1913 | $276,658,672.62 | 0.10 |

| Grover Cleveland | 1893–1897 | $271,686,979.77 | 0.18 |

| James Madison | 1809–1817 | $66,468,773.07 | 1.17 |

| James Buchanan | 1857–1861 | $61,881,041.87 | 2.16 |

| James Polk | 1845–1849 | $47,136,555.68 | 2.96 |

| George Washington | 1789–1797 | $11,003,970.83 | 0.15 |

| John Tyler | 1841–1845 | $10,674,427.47 | 2.03 |

| Martin Van Buren | 1837–1841 | $4,913,917.71 | 14.58 |

| John Adams | 1797–1801 | $973,571.47 | 0.01 |

| Zachary Taylor | 1849–1850 | $390,914.86 | 0.01 |

| James Garfield | 1881-1881 | $0.00 | 0.00 |

| William Henry Harrison | 1841-1841 | $0.00 | 0.00 |

| Millard Fillmore | 1850–1853 | −$3,649,655.85 | −0.06 |

| John Quincy Adams | 1825–1829 | −$25,367,019.04 | −0.30 |

| Thomas Jefferson | 1801–1809 | −$26,014,858.71 | −0.31 |

| Franklin Pierce | 1853–1857 | −$31,103,285.85 | −0.52 |

| James Monroe | 1817–1825 | −$39,703,532.45 | −0.32 |

| Andrew Jackson | 1829–1837 | −$58,084,455.84 | −0.99 |

| Benjamin Harrison | 1889–1893 | −$73,067,236.10 | −0.05 |

| Andrew Johnson | 1865–1869 | −$92,195,655.80 | −0.03 |

| Rutherford B. Hayes | 1877–1881 | −$136,287,822.52 | −0.06 |

| Chester Arthur | 1881–1885 | −$205,048,696.44 | −0.10 |

| Grover Cleveland | 1885–1889 | −$244,911,950.91 | −0.13 |

| Ulysses S. Grant | 1869–1877 | −$383,150,821.84 | −0.15 |

| Warren Harding | 1921–1923 | −$1,627,743,187.18 | −0.07 |

| Calvin Coolidge | 1923–1929 | −$5,418,618,881.26 | −0.24 |

| Legend: Red indicates positive debt change. Blue indicates negative or no debt change. Source: self.inc | x @LinAnalytics | lindsayalston.com |

|||

| Debt At Start | Debt When Leaving Office |

|---|---|

| $11,909,829,003,512 | $20,244,900,016,054 |

| $20,244,900,016,054 | $28,428,918,570,049 |

| $28,428,918,570,049 | $35,464,673,929,172 |

| $ 5,807,463,412,200 | $11,909,829,003,512 |

| $ 997,855,000,000 | $ 2,857,430,960,187 |

| $ 2,857,430,960,187 | $ 4,411,488,883,139 |

| $ 4,411,488,883,139 | $ 5,807,463,412,200 |

| $ 698,840,000,000 | $ 997,855,000,000 |

| $ 22,538,672,560 | $ 258,682,187,410 |

| $ 475,059,815,732 | $ 698,840,000,000 |

| $ 353,720,253,841 | $ 475,059,815,732 |

| $ 305,859,632,996 | $ 353,720,253,841 |

| $ 266,071,061,639 | $ 288,970,938,610 |

| $ 2,916,204,914 | $ 23,977,450,553 |

| $ 288,970,938,610 | $ 305,859,632,996 |

| $ 258,682,187,410 | $ 266,071,061,639 |

| $ 16,931,088,484 | $ 22,538,672,560 |

| $ 90,580,874 | $ 2,680,647,870 |

| $ 2,143,326,934 | $ 2,639,546,241 |

| $ 1,817,672,666 | $ 2,143,326,934 |

| $ 2,639,546,241 | $ 2,916,204,914 |

| $ 1,545,985,686 | $ 1,817,672,666 |

| $ 57,023,192 | $ 123,491,965 |

| $ 28,699,832 | $ 90,580,874 |

| $ 15,925,303 | $ 63,061,859 |

| $ 71,060,509 | $ 82,064,479 |

| $ 5,250,876 | $ 15,925,303 |

| $ 336,958 | $ 5,250,876 |

| $ 82,064,479 | $ 83,038,051 |

| $ 63,061,859 | $ 63,452,774 |

| $ 2,069,013,570 | $ 2,069,013,570 |

| $ 5,250,876 | $ 5,250,876 |

| $ 63,452,774 | $ 59,803,118 |

| $ 83,788,433 | $ 58,421,414 |

| $ 83,038,051 | $ 57,023,192 |

| $ 59,803,118 | $ 28,699,832 |

| $ 123,491,965 | $ 83,788,433 |

| $ 58,421,414 | $ 336,958 |

| $ 1,619,052,922 | $ 1,545,985,686 |

| $ 2,680,647,870 | $ 2,588,452,214 |

| $ 2,205,301,392 | $ 2,069,013,570 |

| $ 2,069,013,570 | $ 1,863,964,873 |

| $ 1,863,964,873 | $ 1,619,052,922 |

| $ 2,588,452,214 | $ 2,205,301,392 |

| $ 23,977,450,553 | $ 22,349,707,365 |

| $ 22,349,707,365 | $ 16,931,088,484 |