The Affordable Care Act (ACA), enacted in 2010, marked a significant milestone in the U.S. healthcare system, aiming to reduce the uninsured population and increase access to affordable health insurance. A key feature of the ACA was the individual mandate, which required most Americans to have health insurance or face a financial penalty. Using health insurance coverage data from 2008 to 2023, excluding 2020 (due to the COVID-19 pandemic), we analyzed the uninsured rates before and after the ACA to evaluate its impact.

Methodology

Data from the Kaiser Family Foundation (KFF) was consolidated from multiple files containing health insurance coverage information for individuals aged 0-64. After combining the datasets, the uninsured rate (percentage of individuals without health insurance) was calculated for the pre-ACA period (2008-2009) and post-ACA period (2011-2023). A Welch Two-Sample t-test was conducted to test the hypothesis:

- Null Hypothesis (H0H_0): The ACA did not significantly reduce uninsured rates.

- Alternative Hypothesis (HAH_A): The ACA significantly reduced uninsured rates.

Results

The t-test yielded the following results:

- t-value: 8.3134

- Degrees of Freedom (df): 137.08

- p-value: 4.083×10−144.083 \times 10^{-14} (highly significant)

- Mean Uninsured Rate (Pre-ACA): 15.74%

- Mean Uninsured Rate (Post-ACA): 11.50%

- 95% Confidence Interval: [3.40, Inf]

The p-value indicates a statistically significant reduction in uninsured rates post-ACA, with the mean uninsured rate dropping by approximately 4.24 percentage points. This decrease is not attributable to random chance and highlights the ACA’s effectiveness in expanding health insurance coverage.

The Role of the Individual Mandate

The individual mandate was a cornerstone of the ACA’s strategy to reduce uninsured rates. Introduced in 2014, it required most Americans to have health insurance or pay a penalty when filing taxes. This penalty was designed to incentivize enrollment and stabilize insurance markets by ensuring younger, healthier individuals participated. By 2016, the penalty grew to 2.5% of household income or $695 per adult (whichever was higher).

However, the mandate had a polarizing effect. While it successfully encouraged millions of Americans to obtain coverage, it also underscored issues of affordability. For some, the cost of health insurance remained prohibitively high, particularly for those without employer-sponsored insurance or subsidies. Many Americans, especially young adults, chose to pay the penalty instead of enrolling in health plans, finding it more financially viable. For example:

- A healthy individual in their 20s or 30s might have faced monthly premiums exceeding $300, while the penalty for remaining uninsured was significantly lower.

- Those in states that did not expand Medicaid often fell into a coverage gap, making insurance unattainable despite the mandate.

This contrast between being “forced” into coverage by the penalty and choosing to remain uninsured highlights the ACA’s dual effect. On one hand, the mandate expanded access to millions; on the other hand, it exposed the challenges of affordability in achieving universal coverage.

Visual Representation

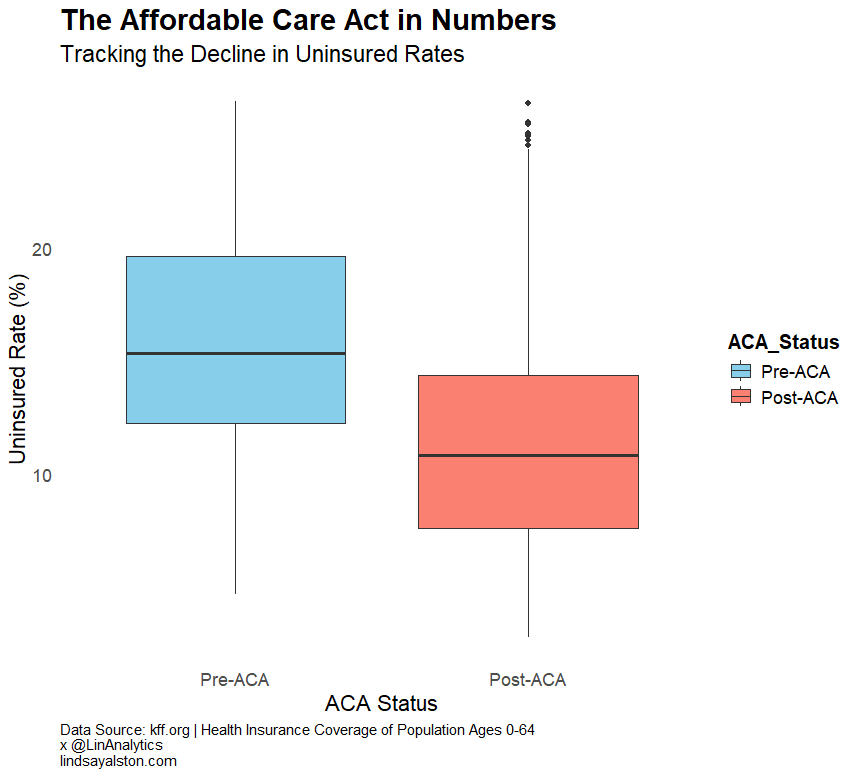

The accompanying boxplot visually demonstrates the difference in uninsured rates between the pre- and post-ACA periods. The median uninsured rate in the post-ACA period is visibly lower, with fewer outliers, signifying a consistent improvement in coverage across states.

Key Observations

- Impact of ACA Implementation: The uninsured rate fell significantly after the ACA was enacted, with the individual mandate and Medicaid expansion serving as key drivers of this change.

- Behavioral Incentives: The financial penalty for not having insurance encouraged many to obtain coverage, stabilizing insurance markets by including younger, healthier individuals. However, it also created resentment among those who found coverage unaffordable.

- Affordability Challenges: Despite the penalty, for some Americans—particularly those in the Medicaid gap or without subsidies—insurance costs remained out of reach, limiting the mandate’s full potential.

- Post-2020 Dynamics: After the penalty was effectively removed in 2019, the uninsured rate has remained relatively stable, suggesting that other ACA provisions (e.g., Medicaid expansion, subsidies) have played a critical role in sustaining coverage gains.

Policy Implications

The ACA’s success in reducing uninsured rates demonstrates the effectiveness of policy interventions like the individual mandate and subsidies. However, affordability remains a critical issue. Addressing this requires further reforms, such as:

- Expanding Medicaid in all states.

- Increasing subsidies for low- and middle-income individuals.

- Addressing high out-of-pocket costs that deter enrollment.

Data Source

This analysis utilized data from the Kaiser Family Foundation (KFF), available at KFF Health Insurance Coverage Population 0-64.

Conclusion

The ACA marked a transformative step in the U.S. healthcare system, significantly reducing the uninsured rate and expanding coverage to millions. However, the tension between affordability and enforcement highlights the complexities of healthcare reform. Future efforts must address these challenges to ensure equitable and universal access to health insurance for all Americans.