In today’s economy, it’s no secret that taxes and inflation are working together to reduce the real value of our incomes. Each month, it feels like paychecks don’t stretch as far as they used to, leaving us wondering: where is all the money going? Let’s break down the numbers and see how inflation and taxes are slowly chipping away at our hard-earned dollars, using a common scenario.

The Scenario: Married Filing Jointly with an $80,000 Income

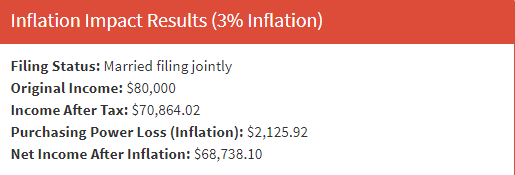

Imagine a married couple filing jointly with a combined income of $80,000. At first glance, $80,000 might seem like a comfortable income, but as we’ll see, taxes and inflation quickly erode this amount, revealing just how much of a burden these economic forces can place on an average household.

- Income After Taxes

After taxes, this couple’s income drops to $70,864.02. The effective tax rate in this example, around 11.4%, may seem manageable, but it’s the first of several hits to their income. - The Impact of Inflation

With a 3% inflation rate, the purchasing power of that post-tax income continues to fall. This couple loses $2,125.92 simply due to inflation, meaning their $70,864.02 now only buys what $68,738.10 could buy last year. That may not seem like much at first, but it’s a noticeable hit when combined with the tax burden. - Real Net Income: What’s Left?

When all is said and done, the couple’s $80,000 nominal income effectively shrinks to $68,738.10 in terms of real purchasing power. In this case, inflation and taxes combined have slashed nearly $11,262 from what this income could buy. That’s a staggering 14% reduction in real income—meaning that while their paycheck might look the same, it buys much less than it used to.

Why This Matters: The Silent Erosion of Wealth

This scenario illustrates a broader trend that impacts countless households. Taxes are often seen as the most visible reduction of income, but inflation acts as a silent tax—one that doesn’t appear on your pay stub but still reduces your purchasing power. This “hidden tax” means that even if wages appear to increase, they may not keep up with the cost of living, effectively eroding any gains.

Example Breakdown:

- Original Income: $80,000

- Income After Tax: $70,864.02

- Purchasing Power Loss (3% Inflation): $2,125.92

- Net Income After Inflation: $68,738.10

Over time, this constant erosion can make it difficult to save, invest, or even maintain the same lifestyle. For many, raises or bonuses are barely enough to keep up with inflation, let alone build wealth or plan for the future.

How This Affects Everyday Life

The effects of this reduction in real income are felt in everyday spending. Here’s how it can play out:

- Housing Costs

Mortgage or rent payments are some of the biggest expenses for most families. With rising inflation, home prices and rent often increase, making it harder to afford quality housing. An income that could comfortably cover these costs a few years ago might now struggle to keep up. - Food and Essentials

Groceries and household essentials are also impacted by inflation. As the cost of goods rises, the same $68,738.10 doesn’t buy as many groceries as it did when it was worth more. Families are forced to make difficult choices, cut back on quality, or forego non-essential purchases. - Healthcare

Medical expenses and insurance premiums are another area where inflation can be particularly painful. If wages don’t keep up, families might find themselves with less access to quality healthcare or needing to cut back on other essentials to cover medical bills. - Education and Childcare

For families with children, education and childcare are major expenses. As prices in these sectors continue to rise, more of the family budget is needed, which may mean sacrificing other priorities, from family vacations to savings for college.

Long-Term Consequences: Wealth Accumulation and Financial Security

The steady drain caused by taxes and inflation doesn’t just impact monthly expenses; it also affects long-term financial health. When people have less money left over after taxes and inflation, it becomes harder to save for emergencies, invest for retirement, or build wealth. The loss of purchasing power year over year means that even with regular raises, families might struggle to improve their financial standing. Instead of climbing the economic ladder, many find themselves running in place or, worse, falling behind.

For example, if this couple tried to save or invest part of their income, the effect of inflation would mean that even those investments would need to outpace inflation just to retain their value. This erodes the compounding potential of long-term investments, making it harder to secure a stable future.

What Can Be Done?

While individual actions can mitigate some effects of inflation and taxes, broader policy changes are often required to address the root causes of these issues. Here are a few ways that individuals and policymakers can approach the problem:

- Advocating for Tax Reform

Policymakers could consider reducing the tax burden on middle-income families, which would leave more money in their pockets and improve purchasing power directly. - Combating Inflation at the Policy Level

Controlling inflation requires careful economic policy, including responsible money printing practices by the Federal Reserve. Reducing unnecessary spending and avoiding excessive stimulus can help manage inflation. - Investing in Inflation-Protected Assets

On a personal level, individuals can look into inflation-protected assets, such as Treasury Inflation-Protected Securities (TIPS) or certain real assets like property, which often appreciate with inflation. - Financial Literacy and Budgeting

Becoming financially literate and learning to budget effectively can help families navigate inflationary periods. By understanding where money goes and how to prioritize spending, individuals can make the most of their income.

Conclusion: The Real Cost of Inflation and Taxes

Taxes and inflation are a double-edged sword, impacting income in ways that aren’t always obvious but are deeply felt. As we’ve seen, the effects of these factors can mean thousands of dollars in lost purchasing power, which affects not only the present but also the future.

Understanding the impact of these economic forces can empower individuals to make informed financial decisions and advocate for policies that protect their earnings. With a keen eye on where money goes and how to retain its value, we can navigate these economic challenges and work toward a financially secure future.

By analyzing real-world numbers like these, we can shed light on the true cost of inflation and taxes, helping individuals understand why it feels like their paycheck just doesn’t go as far.