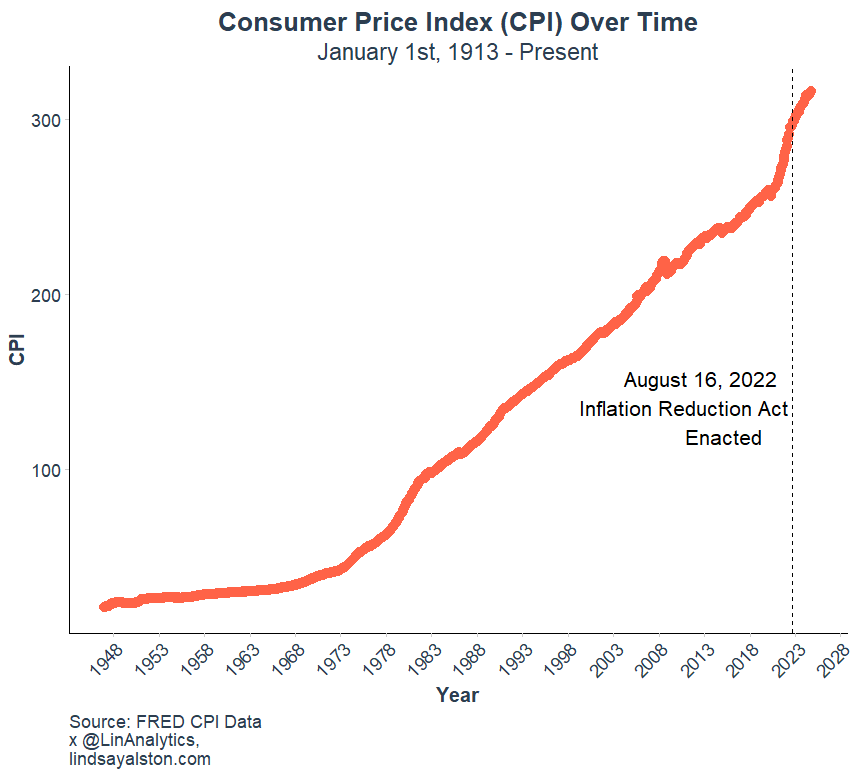

The chart above illustrates the Consumer Price Index (CPI) from January 1, 1913, to the present, highlighting the Inflation Reduction Act’s (IRA) enactment on August 16, 2022 with a dashed vertical line. This act aimed to combat rising inflation and stabilize prices. To assess its impact, we conducted a statistical analysis to answer the question: Did the Inflation Reduction Act reduce inflation?

Hypothesis Testing

- Null Hypothesis (H₀): The Inflation Reduction Act had no effect on inflation (mean CPI before and after the IRA are equal).

- Alternative Hypothesis (H₁): The Inflation Reduction Act significantly reduced inflation (mean CPI after the IRA is lower than before).

Statistical Results

To evaluate the IRA’s effect, a two-sample t-test was conducted comparing the mean CPI before and after the IRA’s enactment. The results are as follows:

- Mean CPI before IRA (pre-IRA): 115.78

- Mean CPI after IRA (post-IRA): 306.86

- Difference in Means: An increase of 191.08 points.

- t-value: -11.881

- Degrees of Freedom (df): 932

- p-value: < 2.2e-16 (highly significant)

- 95% Confidence Interval for the Difference in Means: [-222.64, -159.51]

Interpretation of Results

The analysis shows a statistically significant increase in the mean CPI after the IRA was enacted, as indicated by the t-test. The p-value (< 2.2e-16) is far below the 0.05 significance threshold, meaning we reject the null hypothesis. However, the results do not support the hypothesis that the IRA reduced inflation. Instead, the CPI increased sharply in the post-IRA period.

Several factors could explain this trend:

- Lagging Policy Effects: Inflation reduction policies often take time to manifest in measurable economic outcomes. The immediate post-IRA period may not yet reflect the policy’s long-term effects.

- Pre-existing Inflationary Momentum: Inflationary pressures, such as global supply chain disruptions and energy price shocks, may have continued to impact CPI after the IRA.

- External Economic Factors: Broader economic conditions, such as international conflicts or monetary policy changes, could have overshadowed the IRA’s intended effects.

Conclusion

Based on the data, the Inflation Reduction Act has not yet demonstrated a reduction in inflation as measured by the CPI. Instead, the CPI increased significantly in the post-enactment period, suggesting that other inflationary pressures or delayed policy effects may be at play. Further analysis with long-term data is needed to determine whether the IRA achieves its goal of reducing inflation in the years to come.