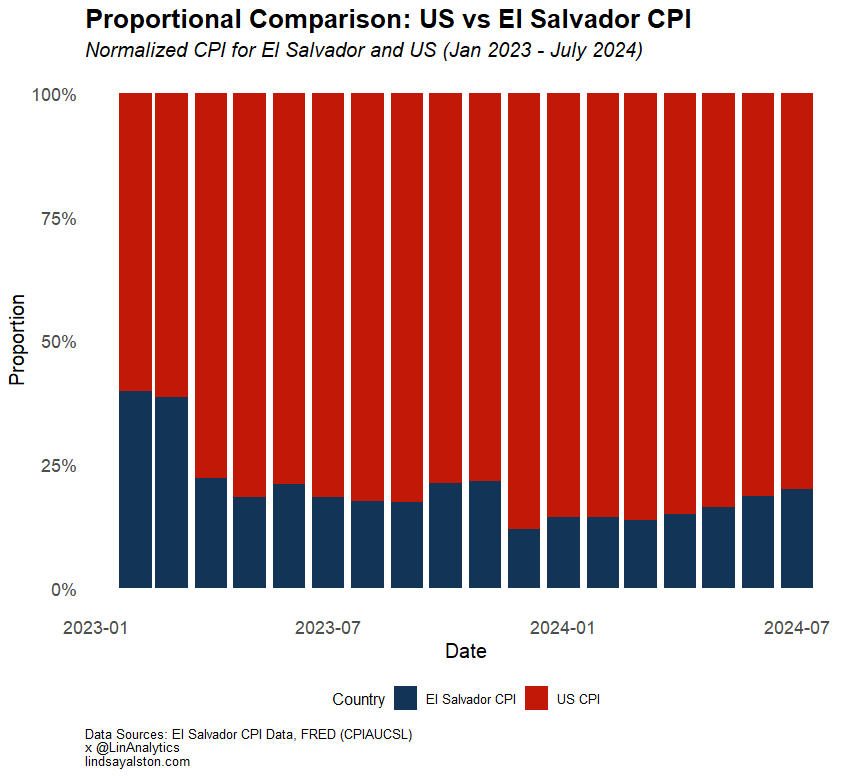

The United States could benefit from examining El Salvador’s approach to inflation management, which underscores the importance of fiscal discipline and monetary constraints. As a dollarized economy, El Salvador does not have the ability to print its own currency, tying its inflation rate to the stability of the US dollar. This structural limitation forces the country to operate within its fiscal means, avoiding excessive spending and inflationary policies. As a result, El Salvador’s Consumer Price Index (CPI) remains relatively stable compared to the US, where large-scale monetary expansion has fueled significant inflationary pressures.

Why El Salvador’s Inflation Remains Stable While the U.S. Struggles

El Salvador’s fiscal responsibility stands in stark contrast to the United States’ recent history of aggressive monetary policies. During crises like the COVID-19 pandemic, the US Federal Reserve dramatically expanded the money supply through quantitative easing and stimulus spending. While these measures stabilized the economy in the short term, they also drove inflation higher as the money supply outpaced the production of goods and services. This devaluation of the dollar’s purchasing power has significantly contributed to the growing CPI gap between the two nations.

The Risks of Money Printing vs. the Benefits of Fiscal Discipline

El Salvador’s model highlights the benefits of operating under monetary constraints. Without the ability to print money, the country must carefully balance its budgets and manage spending, leading to greater price stability. Meanwhile, the US—empowered by its position as the issuer of the world’s reserve currency—has relied on money printing to fund government spending and economic stimulus, often at the cost of long-term economic stability. The result is a CPI that reflects the consequences of fiscal excess and loose monetary policy.

How Dollarization Forces Responsible Economic Policies

El Salvador’s dollarization model inherently enforces fiscal discipline. By adopting the US dollar, the country forfeits the ability to devalue its currency to pay off debt or stimulate exports artificially. While this limits flexibility in economic downturns, it also creates a stable environment where inflation is less likely to spiral out of control. This contrasts with the US, where unchecked money printing has eroded purchasing power and fueled inflation, especially during recent years of economic stimulus.

What the U.S. Can Do to Control Inflationary Pressures

While the US economy is far more complex and globally interconnected than El Salvador’s, the lessons are clear. Limiting excessive money supply growth and practicing fiscal restraint could help mitigate inflationary pressures, stabilize purchasing power, and ensure sustainable economic growth. El Salvador demonstrates that fiscal responsibility, while challenging, can provide stability in an increasingly volatile global economy.

The US may not need to adopt El Salvador’s dollarization model, but it can take inspiration from its disciplined approach to managing inflation. By prioritizing responsible spending, managing debt, and resisting the temptation of unchecked monetary expansion, the United States could achieve a healthier balance between economic growth and inflation control. This approach would not only benefit domestic stability but also strengthen the dollar’s role as a reliable global currency.