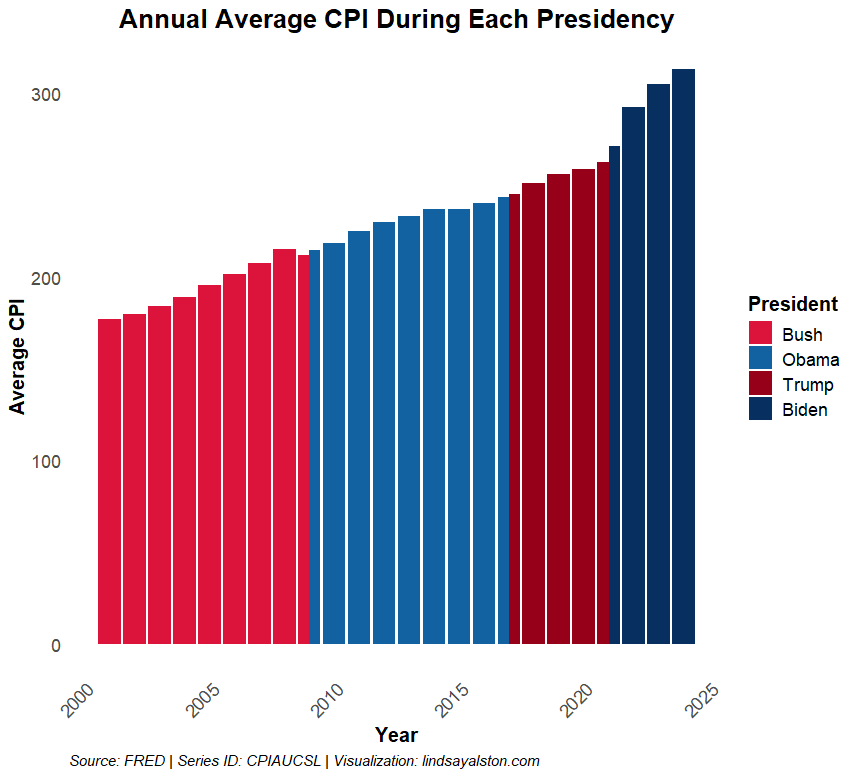

The chart presents a comprehensive view of the annual average Consumer Price Index (CPI) during the presidencies of George W. Bush, Barack Obama, Donald Trump, and Joe Biden. By examining this data, we gain insights into the inflationary trends that have shaped the U.S. economy over the past two decades.

The Bush Era (2001–2009):

George W. Bush’s presidency began with a relatively low and stable CPI, reflecting moderate inflation levels during his first term. However, as the financial crisis of 2008 unfolded, inflation began to decelerate sharply due to a contraction in consumer demand. This period highlights how economic crises can suppress inflation despite longer-term trends of rising prices.

The Obama Years (2009–2017):

Barack Obama assumed office during the Great Recession, where inflation remained subdued initially as the economy struggled to recover. Over the course of his two terms, the CPI gradually increased as stimulus measures and economic growth restored stability to the economy. By the end of his presidency, inflation had returned to more typical levels, reflecting a strengthened labor market and consistent consumer demand.

The Trump Administration (2017–2021):

Donald Trump’s term saw steady inflationary growth during the first three years, reflecting a period of economic expansion. However, the COVID-19 pandemic in 2020 introduced severe economic disruptions. Unlike previous recessions, supply chain constraints and fiscal stimulus created inflationary pressures even during a downturn, leading to a sharp rise in CPI toward the end of his presidency.

The Biden Presidency (2021–Present):

Joe Biden’s presidency began amidst lingering pandemic disruptions and unprecedented fiscal and monetary stimulus. These factors, combined with global supply chain bottlenecks, contributed to a steep acceleration in inflation, as seen in the rising CPI levels during his term. By 2023, inflation remained a dominant issue, with policymakers focusing on mitigating its impact on households and businesses.

Key Takeaways:

The chart underscores the steady, cumulative rise of the CPI over time, highlighting how inflation persists as a long-term challenge for the U.S. economy. While specific events like financial crises and pandemics create short-term fluctuations, the overarching trend reflects the continuous erosion of purchasing power due to inflation.

The data also reveals the significant influence of external factors—such as global economic conditions, fiscal policies, and central bank actions—on inflation trends. Regardless of the administration, inflation is a multifaceted challenge that requires coordinated efforts across monetary and fiscal policy to ensure economic stability.

Conclusion:

Inflation, as represented by the CPI, is not merely a product of individual presidencies but a reflection of broader economic forces. Understanding these trends is essential for creating policies that balance growth with price stability. The chart serves as a reminder of the importance of addressing inflation proactively to protect the purchasing power of American households and ensure sustainable economic progress.