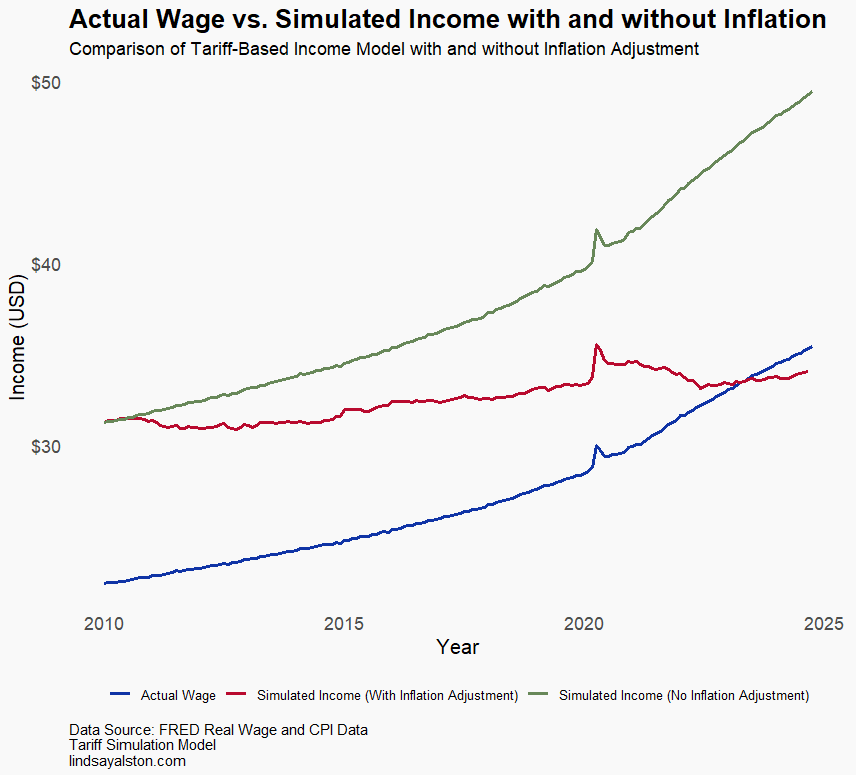

The analysis compares three income trajectories under a hypothetical tariff-only tax model: Actual Wage, Simulated Income with Inflation Adjustment, and Simulated Income without Inflation Adjustment. The Actual Wage line represents historical real wage data, showing a slow but steady growth over time. This baseline highlights income trends under the current tax system and economic conditions.

The Simulated Income with Inflation Adjustment line incorporates assumptions specific to the tariff-only model and adjusts the projected income for inflation to account for the erosion of purchasing power over time. The model includes several parameters: a tax savings rate of 22.5%, an income growth rate of 20%, and varying tariff rates. General imports are assumed to have a 20% tariff on a 10% import cost, while imports from China face a 60% tariff on the same 10% import cost. Additionally, 25% of total imports are assumed to come from China. This tariff model would remove income tax entirely, redirecting revenue generation to tariffs on imported goods. The inflation-adjusted income line shows that while households may see a nominal increase in income under this model, rising prices reduce the effective value of these gains, diminishing real purchasing power.

In contrast, the Simulated Income without Inflation Adjustment line represents the same projected income under the tariff-only tax model but without accounting for inflation. This scenario assumes that income gains retain their full purchasing power, offering a more optimistic perspective. Here, all additional income translates directly into real income gains, suggesting that in a low or no-inflation environment, the tariff-only tax model could provide substantial financial benefits to households, particularly those in middle- and lower-income brackets. This line emphasizes the compounded effect of consistent income growth over time, highlighting a scenario where income increases are fully realized.

In summary, the analysis illustrates how the specific parameters of the tariff-only model—tax savings, income growth, and varying tariffs—could impact income under two conditions: with and without inflation. When inflation is accounted for, the projected income gains are partially offset, reflecting reduced purchasing power. However, without inflation, the tariff-based model yields clear, substantial income increases, suggesting that stable prices are crucial to realizing the full benefits of a tariff-only tax system. This dual analysis underscores the importance of inflation control for a tariff-based tax model to succeed in boosting real income effectively.